estate and gift tax exemption sunset

Website builders As 2026 approaches families who have more than 10M or individuals with more than 5M may be served well from making more than 5M of completed gifts and utilizing the higher estate exclusions before they sunset. The current estate tax exemption is set to expire at sunset in 2025 at which time it could revert to the pre-2018 exemption level of 5 million for an individual taxpayer.

2021 Federal Gift Estate Tax Exemption Update Sessa Dorsey

Proposed regulations were published on December 31 2020.

. New York Estate Tax Exemption Amount. That could result in your estate having to pay over 49 million in federal taxes leaving your heirs with about 1474 million in after- tax assets rather than 1964 million if you made the gift sooner. The estate tax is a tax on your right to transfer property at your death.

The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. Spouses splitting gifts must always file Form 709 even when no taxable gift is incurred. Spouses can together gift 30000 per year.

New Yorks exemption from estate tax increased from 5930000 to 6020000 for 2022. Notably the TCJA provision that doubled the gift and estate tax exemption from 5 million to 10 million adjusted annually for inflation will revert to pre-2018 levels after 2025. Specifically the provision that increased the estate and gift tax exemption from 5 million to 10 million adjusted annually for inflation its 1206 million in 2022.

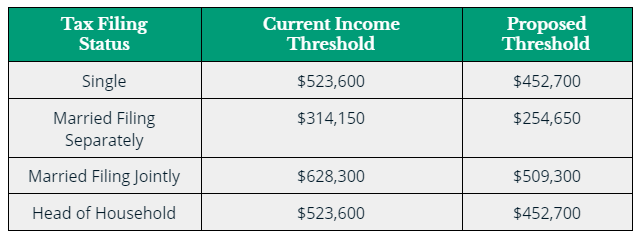

TCJA doubled the estate and gift tax exemption to 112 million for single filers 224 million for couples and continued to index the exemption levels for inflation. Said another way you should keep reading if your estate value exceeds 11580000 5790000 if unmarried. This sunset raises the question as to what happens if a taxpayer makes a taxable gift before 2026 when the threshold is 12 million or more but dies after 2026 when the threshold has been cut in half.

Thats because the increase in the exemption is due to sunset as of January 1 2026 meaning that estate gift and generation-skipping transfer tax exemptions will return to their pre-2018 levels. Things to know before estate tax laws sunset in 2025. Starting January 1 2026 the exemption will return to 549 million adjusted for inflation.

The federal estate gift and generation-skipping transfer tax exemption amounts are currently set at 1158 million per individual or 2316 million for married couples. If the federal estate and gift tax exemption is in fact reduced to 6020000 in 2022 the GST exemption will mirror that reduction. For many boomers the sunset of the current estate and gift tax provisions provides the greatest gloom.

On the contrary because of the scheduled sunset of current estate tax laws in 2026 you should read this article carefully if your estate will likely be worth more than half the current tax-free gift limit when you die. Under current law the estate and gift tax exemption is 117 million per person. Making large gifts now wont harm estates after 2025 On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to.

The grantor of the trust has the flexibility to forgive the loan prior to the sunset date and complete the gift. Find some of the more common questions dealing with basic estate tax issues. While it is possible that Congress could vote to extend them we need to assume at this time that the increased exemptions will go back to their previous levels.

However if your gift exceeds 16000 to any person during the year you have to report it on a gift tax return IRS Form 709. Estate and Gift Taxes. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. With inflation this may land somewhere around 6 million.

Over the last couple of years as there was concern that the gift and estate tax exemption along with the related generation-skipping transfer tax exemption would be reduced back to pre-2017 levels many individuals made gifts or other transfers to utilize their remaining gift and estate tax exemption. This resulted in a unified lifetime exemption of 11400000 in 2019 and. Gift money now before estate tax laws sunset in 2025.

Additionally in 10 years the gift and estate tax exemption will have likely reverted back to the lower 549 million amount for dates after 2025. Nothing has happened politically and the doubling of the estate and gift tax exemption is scheduled to sunset on January 1 2026 at the end of the 7 th year. The estate and gift tax exemption is first used during.

Once you give more than the annual gift tax exclusion you begin to eat into your lifetime gift and estate tax exemption. This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018. It consists of an accounting of everything you own or have certain interests in at the date of death.

How Gift Taxes Work The annual gift tax exclusion is 16000 in 2022. Learn about the COVID-19 relief provisions for Estate Gift. If nothing happens on Capitol Hill the exemption will return to pre-TCJA levels in 2026.

The Tax Cuts and Jobs Act which was enacted in December 2017 provided that the current 10000000 base exemption amount for the estate gift and Generation-Skipping Transfer taxes is effective through 2025 and reverts on January 1 2026 to the 5000000 base exemption amount established by the American Taxpayer Relief Act of 2012. Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information. March 18 2022 at 1000 AM.

Estate and gift tax. Fortunately the IRS has answered this question. Some estate planning techniques to consider for your clients before the end of 2025 when the 12060000 per person lifetime estate and gift tax exemption will sunset.

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. By utilizing their remaining exemption these individuals.

The exemption does not apply however to estates worth more than 105 of the New York exemption meaning the entire estate is subject to the tax. State Estate and Gift Taxes. As the IRS released on November 22 2019 The Treasury Department and the Internal Revenue Service today issued.

After that the gift is subject to gift tax and youll need to use the second type of exemption the lifetime exemption. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation.

Eye On The Estate Tax Nottingham Advisorsnottingham Advisors

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

New Ranking Says These Are The Us S Best Places To Retire Best Places To Retire The Good Place Places

Gift And Estate Tax Planning In 2021 Baker Tilly

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

A New Era In Death And Estate Taxes

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

What Happened To The Expected Year End Estate Tax Changes

Gifting Real Estate Under German Property Law Neubau Kompass

Proposed Tax Law Changes Where We Are Focused Relative Value Partners

German Inheritance Tax What You Need To Know N26

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Life Insurance Trusts Offer Discounts On Estate Tax Wealth Planning Estate Tax Life Insurance

Estate Taxes Under Biden Administration May See Changes

Biden Administration May Spell Changes To Estate Tax Exemptions And Basis Step Up Rule

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel